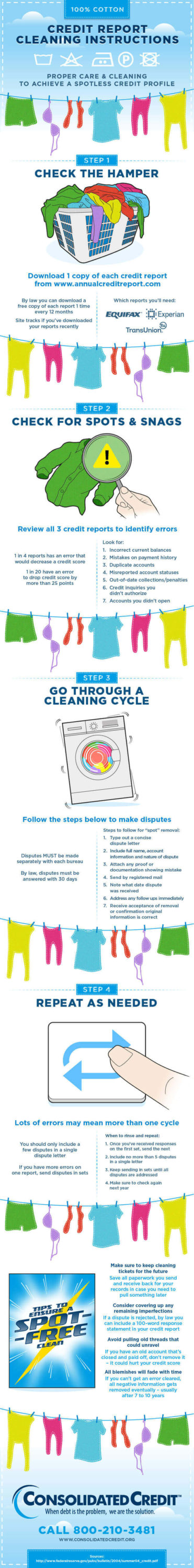

Free Credit Repair: Step-by-Step Credit Report Cleaning Instructions

Don’t pay for a credit repair service, when you can dispute credit report errors for free on your own!

Important Note: Debt elimination should always come before credit repair. If you are currently in the process of paying off debt, it’s recommended that you the your elimination plan first. That way, you can make your credit report shows that your accounts are paid off.

Free credit repair vs. paid repair services

As the infographic instructions show, you can do the entire credit repair process for free on your own. There is no need to pay anyone to dispute credit report errors. If you have a limited budget, it’s recommended that you use do-it-yourself credit repair to avoid any additional cost.

That being said, the Credit Repair Organizations Act outlines the process for using a third-party credit repair services. You can retain a third party to dispute mistakes on your behalf. They must be a licensed attorney in your state of residence. You then effectively give them Power of Attorney to make disputes for you.

This can save you time and help ensure the disputes you make are as effective as possible. State-licensed credit repair attorneys have experience in making disputes, so they know the ropes. They can help you frame disputes correctly and ensure you have al the proper documentation.

Tip No. 1: Avoid national credit repair services

In order for a national company to make lawful credit dispute, they must have a licensed attorney on retainer in each state. With that in mind, be cautious when it comes to national credit repair service advertising. You should only trust a credit repair service if it works with a network of licensed attorneys. Otherwise, opt for local credit repair services with licensed attorneys on staff.

Tip No. 2: Be wary of big claims

Credit repair is very specific to individual financial situations. People have different credit scores that they achieved through a very specific set of actions. No two credit histories are alike.

Additionally, credit repair only gives you the ability to correct mistakes and remove unverifiable information from your report. Any improvement in your credit score that results from that is really just a great side effect.

This means that you shouldn’t expect that credit repair will dramatically improve your credit score. Your goal should be to achieve a clean, error-free report. With that in mind, credit repair companies that make claims about getting you to a certain credit score are usually false. That’s just not a guarantee that they can make.

Tip No. 3: Never violate the law on someone’s instructions

Some fraudulent companies may try to convince you to break the law to achieve a better score. They specifically tell you to get a new Social Security number, or to use an Employer Identification Number. You get new credit and attempt to start a new credit report to avoid your old one. This is against federal law and you can face criminal charges for following this advice!

If a company gives you this advice, do not sign up for anything. End the conversation and contact the Consumer Financial Protection Bureau (CFPB) and Fair Trade Commission (FTC).

Use this infographic

<a href="https://www.consolidatedcreditsolutions.org/infographics/free-credit-repair-instructions/" target="_blank"><img src="https://www.consolidatedcreditsolutions.org/wp-content/uploads/2017/04/us-cleaning-instructions_ig-opt.jpg" alt="Graphic displaying how to repair your credit" class="img-responsive" /></a>