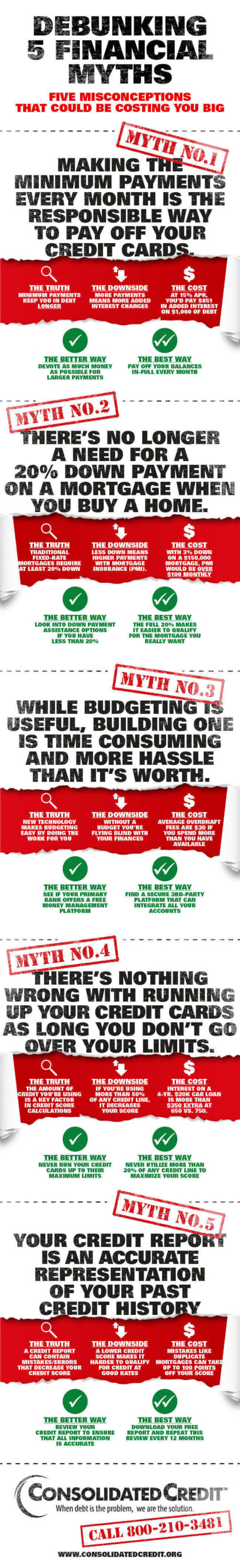

Debunking 5 Financial Myths

Five misconceptions that could seriously impact your bottom line.

[sc:share]

Financial lessons are often learned by trial and error – you don’t really know what you don’t know until an issue arises. However, this means lack of understanding and common misconceptions can often end in financial distress that could have been avoided if you simply knew better to begin with. It simply leaves too much room for error that can negatively impact your bottom line.

With that in mind, Consolidated Credit put together the following infographic in an effort to debunk five common financial misconceptions that often lead consumers into financial distress. By learning these lessons now and developing better strategies for success, you can avoid running into problems down the road. Each lesson shows you how much you stand to lose, as well as what you can do to overcome that particular challenge effectively.

If you’ve already gotten into trouble because you didn’t have the knowledge you needed to plan ahead effectively, we can help. Call Consolidated Credit today at 1-888-294-3130 or complete our online application to request a free consultation with a certified credit counselor. We also have a special Financial Literacy Hotline to help answer all of your questions. Call 1-888-294-3130 to get the information you need without delay.

Use this infographic

<a href="https://www.consolidatedcreditsolutions.org/infographics/debunking-5-financial-myths/" target="_blank"><img src="https://www.consolidatedcreditsolutions.org/wp-content/uploads/2017/04/us-debunking-financial-myths_05-01.jpg" alt="Graphic displaying the facts on 5 financial myths" class="img-responsive" /></a>