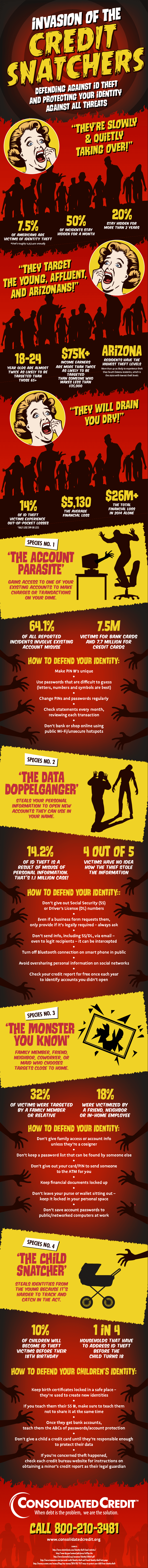

Invasion of the Credit Snatchers!

Protecting your identity from personal data doppelgangers.

Identity theft is a serious problem in the U.S. and new technology is only making it easier to steal your data. Here’s what you need to know if you want to keep your identity safe.

The range of ways that identity thieves can get their hands on your personal information and credit data is only getting wider and more varied. As technology makes it easier for consumers to access and use financial accounts and credit, it also increases the potential for ID theft.

What to do if your identity is snatched

Take these ten steps if you find your personal information has been compromised:

- If you believe any specific accounts have been compromised, contact those credit issuers and financial institutions to let them know.

- When possible (usually for credit cards), place alerts on those accounts so the creditor will be required to call you to verify those purchases.

- In the case of debit cards or credit cards that you know for certain are in use by someone else, cancel those cards and have new ones issued.

- If you have incurred any losses from the theft, file a police report – you may need it to mitigate the losses and if you file an ID theft claim with the FTC.

- You should also contact each credit bureau to report the issue so you can place a fraud alert on your credit report. You can access each bureau’s identity theft portal using the following links: Experian, Equifax, TransUnion.

- By placing an initial fraud alert any creditor, lender, or other financial institution must verify new account creation with you before the account can be opened; you will also be blocked from any pre-screened credit offers. The alert will remain in place for 90 days.

- You only have to contact one bureau – they will contact the other two bureaus to report the alert request.

- Note that by placing a fraud alert, you are entitled to receive an additional free copy of your credit report from each credit bureau. This way, you can check for fraud.

- If an account is opened in your name – even if it happens before you can place the alert – you are permitted to request a copy of the credit or loan application; the business must respond within 20 days.

- You should also report the theft through the FTC website.

Use this infographic

<a href="https://www.consolidatedcreditsolutions.org/infographics/id-theft-credit-snatchers/" target="_blank"><img src="https://www.consolidatedcreditsolutions.org/wp-content/uploads/2017/04/cc-halloween-ig-us_10-01-opt.png" alt="Graphic displaying on how to not lose your identity to the Credit Snatchers" class="img-responsive" /></a>