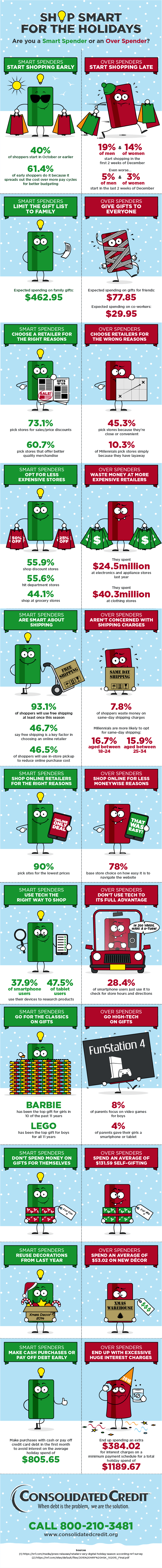

Holiday Smart Spenders vs. Over Spenders

There’s a right way and a wrong way to shop at the holidays to avoid debt.

It’s the most expensive shopping season of the year and often leads to high credit card debt that you could still be paying off next holiday season. This infographic can help you be a smart spender so you can avoid a post-holiday credit card debt hangover.

Eliminating holiday debt fast

Ideally as a Smart Spender, you pay for everything you purchase with cash, debit or a pre-paid card so you can avoid accruing holiday debt altogether. However as mentioned in the last point on the infographic above, the holiday shopping season comes with an average price tag of $805.65. Unless you were saving throughout the year and/or started shopping in September or October, you may not be able to afford some expenses without turning to credit to cover some of the transactions.

Tips to build an effective strategy for paying off holiday debt:

- You should only charge up to what you can afford to pay off during the first billing cycle.

- You can use a credit card debt calculator to see how much your credit card transactions will increase your payments – working backwards this can help you set a credit card spending limit for the holidays.

- If you’re choosing to use a credit card for holidays purchases, always choose the credit card with the lowest interest rate.

- Rewards are nice, but if you end up overspending and can’t pay off the debt in the first billing cycle (reward credit cards usually have much higher interest rates) the rewards and whatever discounts you received can be negated by the interest charges.

- Track your credit card transactions through the holidays. If you see you’ve overcharged and won’t be able to pay everything off in the first billing cycle, use the debt calculator link above to make a plan for repayment.

- The faster you pay off the debt, the less interest charges will increase the cost of your purchases. Every month you allow the balance to carry over means more interest is accrued. Never rely on minimum payments, because they keep you in debt longer.

Of course, if you get into real trouble with holiday debt and you find yourself reeling after the New Year, remember we’re here to help. Call Consolidated Credit at 1-888-294-3130 or tell us about your situation though our online application to schedule a free debt and budget evaluation with a certified credit counselor.

Use this infographic

<a href="https://www.consolidatedcreditsolutions.org/infographics/holiday-smart-spenders-vs-over-spenders/" target="_blank"><img src="https://www.consolidatedcreditsolutions.org/wp-content/uploads/2017/04/cc-overspending-ig-opt.png" alt="Graphic displaying whether you are Smart Spender or an Over Spender" class="img-responsive" /></a>