Debt Hangover Cures

How to ensure holiday debt doesn’t hang around to gather interest.

The holidays aren’t always easy on your budget. From trying to give your family the gifts they want to all those one-off expenses that aren’t included in your regular budget, it can be hard to stay ahead so you can avoid relying on credit to get through to the New Year.

As a result, if you’re like most Americans, you end the holiday season with more credit card debt than when you started. It can be hard to rein in the debt and get your finances back under control. In the meantime, those debts are growing as gets interest added every pay cycle. So what can you do to get ahead?

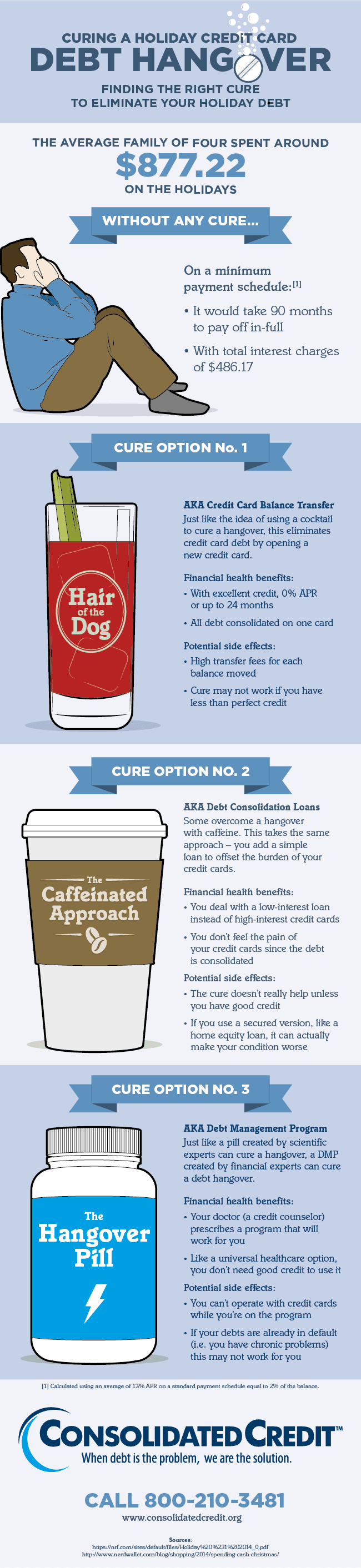

The infographic below outlines your options for eliminating outstanding holiday debt quickly and efficiently. If you have questions or need help selecting the right solution for your unique financial situation, call us at 1-888-294-3130. You can also complete a Free Debt Analysis form to tell us a little about your situation and a certified credit counselor will be in touch.

Use this infographic

<a href="https://www.consolidatedcreditsolutions.org/infographics/debt-hangover-cures/" target="_blank"><img src="https://www.consolidatedcreditsolutions.org/wp-content/uploads/2017/04/us-holiday-debt-hangover_12-01.png" alt="Graphic displaying 3 options to cure a holiday debt hangover" class="img-responsive" /></a>