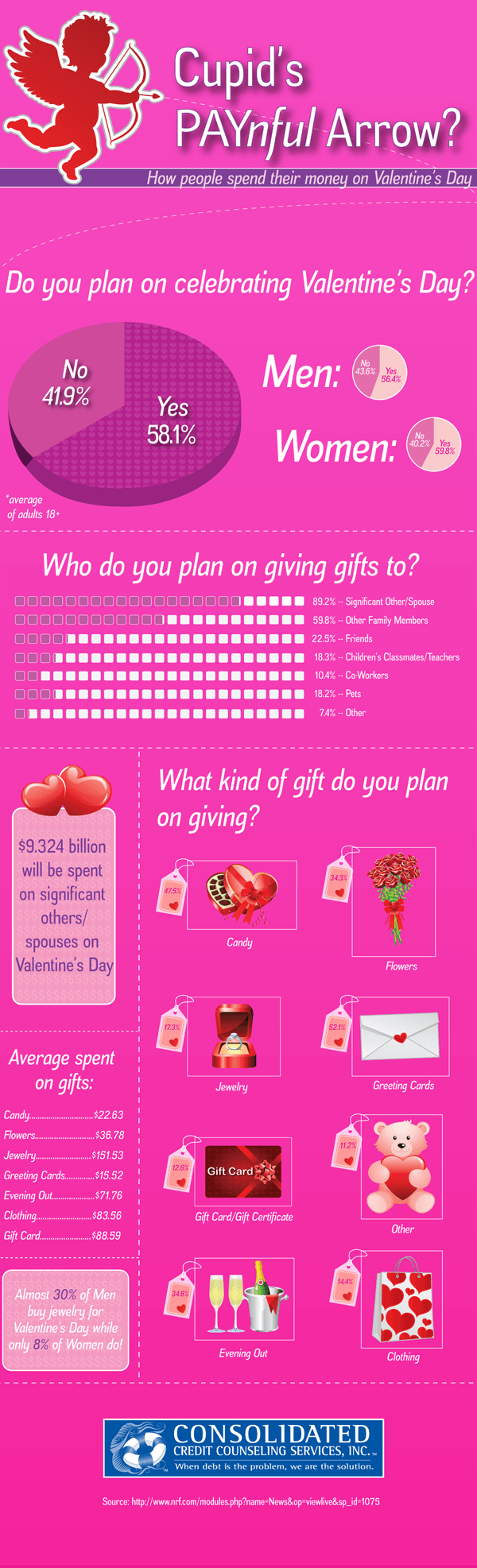

Cupid’s PAYnful Arrow?

How to ensure those warm fuzzies don’t wear a hole in your wallet.

Valentine’s Day is definitely a highly commercialized holiday. If you pay attention to the commercials out now, you can’t say I love you without a diamond ring and at least a dozen long stem roses. But that kind of overspending is a quick way to end a relationship if you run into debt problems.

Store credit or credit cards?

Without a doubt, the biggest gift expense most people usually encounter is jewelry. Buying candy and flowers and cute stuffed animals can set you back a bit, but those are also out-of-pocket expenses that most people can cover with free cash flow in their budgets.

Free cash flow is the amount of money you have leftover in your budget once bills and other necessary expenses get paid. So if you make $2,000 per month and spend $1,900 on necessities, then your free cash flow is $100 per month. In general, you want to cover “one-off expenses” like purchases for holiday, birthdays and other events with your free cash flow. This helps you avoid dipping into savings – unless you have a gift budget allocated in your savings so you can draw out money whenever you need. Otherwise, using free cash helps you avoid credit card debt.

That’s all well and good for a flower arrangement and a cute teddy bear, but what about when you buy something a bit pricier like jewelry? Most people can’t cover that large of an expense in cash, so what’s the best option for paying? Is it better to use store credit programs or put it on a credit card?

That really depends on several factors that all combine to make up the unique financing situation you’re currently in:

- What’s the store credit policy where you’re shopping?

- Does the credit card you’re using have currently have a balance?

- Are you trying to earn credit card rewards?

Store credit often offers low or no interest for a period of time. That means if you can pay off the account before that period expires, you avoid interest charges entirely. On the other hand, the same thing is true with a new credit card. If you have a new rewards credit card that offers low or no interest for a period of time and you have time to pay off the balance before this introductory period ends, then using your credit card will earn rewards.

The most important thing is to eliminate the debt before higher interest charges get applied. So unless you have a brand new credit card, the better bet for getting no interest charges for at least a few months is to opt for store credit. Now, that being said, you have to commit to paying off the debt quickly.

You also need to be careful that you remember to pay off the store credit account. A regular credit card is something you get monthly statements for and you’re accustomed to tracking the account either online or on a mobile device. A new store credit account can get lost in the mix, and if you don’t pay on time they’re usually not going to try to call and work with you to get the debt paid like a credit card issuer will. The debt will be immediately sent to collections and wind up on your credit report as a negative remark.

Use this infographic

<a href="https://www.consolidatedcreditsolutions.org/infographics/cupids-paynful-arrow/" target="_blank"><img src="https://www.consolidatedcreditsolutions.org/wp-content/uploads/2017/04/cupids-paynful-arrow.png" alt="Graphic displaying how people spend money on Valentine's Day" class="img-responsive" /></a>