Back to School 2015

Back to School Shopping: Dos & Don’ts to follow

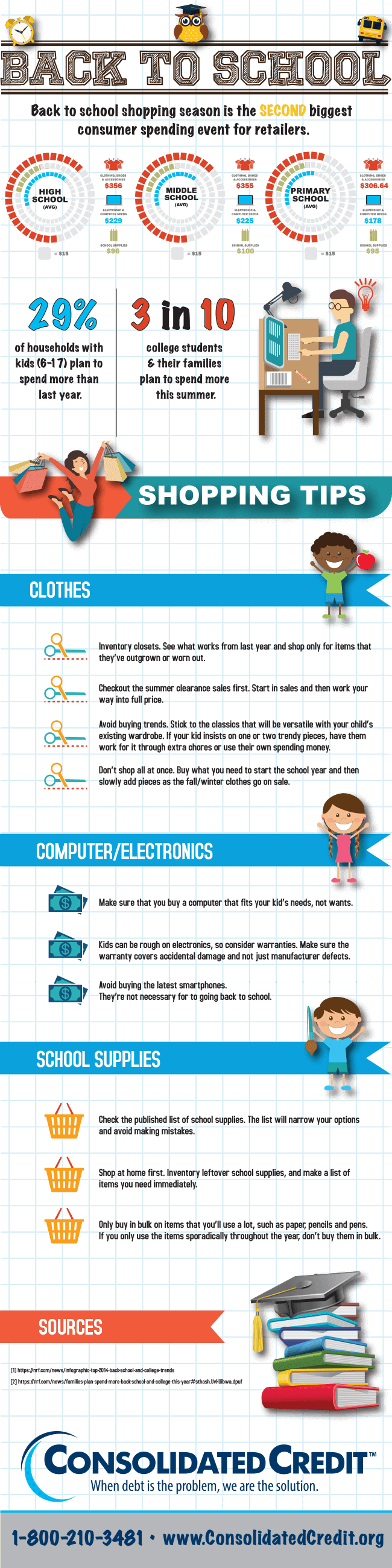

It may sound crazy, but the fall back to school season is the second biggest shopping season of the year after the winter holidays. Between brand name clothes, electronics and new technology, along with ever-expanding supply lists for every class, it’s easy for back to school spending to get out of control… And it only seems to get worse every year.

That might explain why almost one in three families is already planning to spend more than last year, where an estimated $26.5 billion was spent sending children back to school – and that number is only for K-12 families. Families spent an estimated $48.4 billion to get their children ready for college.

With that in mind, the infographic below is designed help you cut costs so you can avoid overspending and the problems it can cause with added credit card debt. Additionally, if you have a college-bound member in the family, we also have a Dorm Decorating on a Dime Infographic to help you save there, too. And remember, if you get into trouble with credit card debt because of overspending, we can help. Call Consolidated Credit at 1-888-294-3130 or complete an online application to request a free debt and budget evaluation.

Use this infographic

<a href="https://www.consolidatedcreditsolutions.org/infographics/back-to-school-2015/" target="_blank"><img src="https://www.consolidatedcreditsolutions.org/wp-content/uploads/2017/04/backtoschool_infographic-outlined.png" alt="Graphic displaying how to go back to school on a budget" class="img-responsive" /></a>