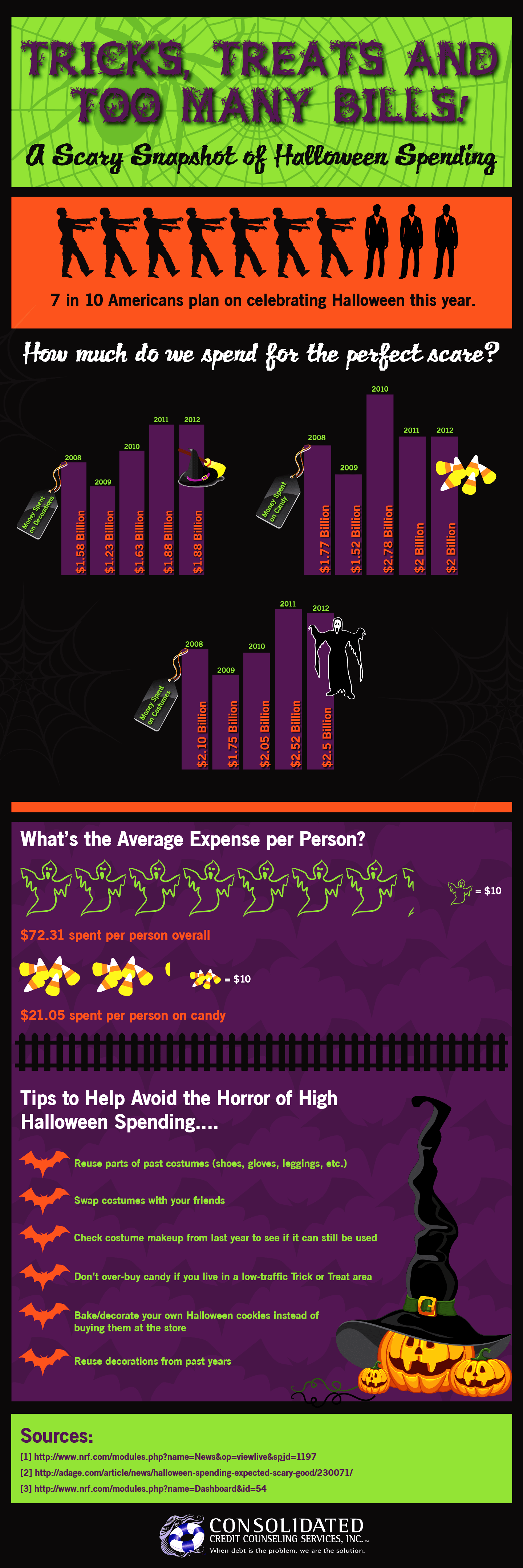

Tricks, Treats & Too Many Bills

Tricks, treats and too many bills can add up to a scary amount of debt.

Although Halloween isn’t the most expensive holiday on the calendar, it is one where it’s easy to go overboard once you get started. Between costumes for everyone, decorations, candy, pet costumes and parties, you can easily bust your budget this October if you’re not careful.

Why so scared of credit card debt?

Now you might be thinking, “Less than $100 is hardly going to send me to the poorhouse. What’s the big deal with charging whatever I want for Halloween and just paying it off?”

Well, that depends.

Remember that $72.31 plus $21.05 for candy is the average – so that includes frugal shoppers and DIY costume makers in there, too. Unfortunately if you decide to go nuts and charge, you’re unlikely to be in either of those groups.

In fact, credit card shoppers are more likely to shop on impulse and also experience something known as purchase acceleration. This is where you start spending on a credit card because you get something for it, then you keep spending because you want to rack up even more rewards. You essentially lose that reticence about putting too many purchases on plastic.

As a result, credit card Halloween spenders are much more likely to overspend than people who are budgeting ahead for their frights. What’s more, the unless all of the purchases made for Halloween in October are paid off before then end of your October grace period, then you’ll be paying at least one month of interest charges on your purchases. Each month of interest added means your Halloween fun costs you that much more before everything is said and done.

And keep in mind that the winter holiday shopping season is right around the corner. That IS the most expensive shopping season of the year, so taking on debt is far more likely. If you’ve already charged for Halloween and then just keep spending through Christmas, you’ll be in for a real scare by the time your bills arrive in January.

Buy November 1 for next year

One final note – if you want to avoid Halloween debt in 2012 altogether, shop now for next year. Costumes and decorations are both on sale right after the holiday. Everything goes into clearance to get it sold and off the shelves. If you buy decorations and costumes now, you’ll avoid credit card debt next year even if you go big on costumes and decorations. Just note this may not work for kids’ costumes, since they can have a growth spurt and be too big for whatever you buy by this time next year.

Use this infographic

<a href="https://www.consolidatedcreditsolutions.org/infographics/2012-tricks-treats-bills/" target="_blank"><img src="https://www.consolidatedcreditsolutions.org/wp-content/uploads/2017/04/tricks-treats-and-too-many-bills-2012-1.png" alt="Graphic displaying how too many bills over Halloween can lead to a scary amount of debt" class="img-responsive" /></a>