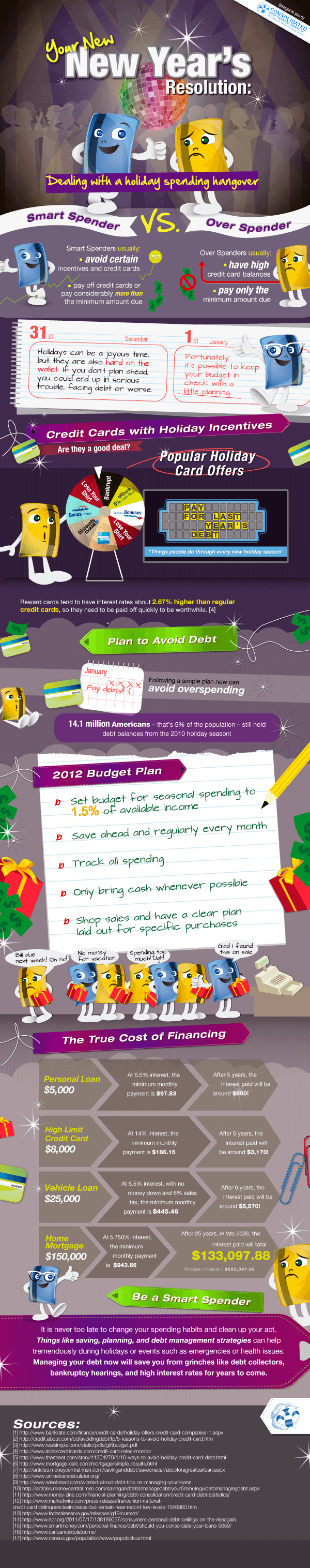

Your New Year’s Resolution

Which type of holiday shopper are you? And how do you switch?

Holiday smart spenders are enjoying a nice start to their New Year. With plans in place for holiday spending, they didn’t take on a large volume of credit card debt, so they’re not left to panic over those high bills coming in this January. Because when it comes to holiday debt, smart really does pay.

Advice for over spenders

If you overspent this holiday season and wound up with a hefty sum of high-interest credit card debt to pay back here at the beginning of the year, don’t panic. Total up your credit card balances and see how much debt you have. Now use a credit card debt calculator to see how long it will take you to pay back the debt if you put in extra money you have as free cash flow in your budget.

If you can’t develop a plan that lets you pay back all of your holiday debts within the first six months of this year, you need a better way to pay it back. Call us at 1-888-294-3130 to get a free debt evaluation from a certified credit counselor. You may be able to consolidate on your own or use a debt management program to pay back everything you borrowed as efficiently as possible.

Making plans to become a smart spender next holiday season

Once you have a plan in place to handle the debt you took on in the last holiday season, it’s time to make a plan to do better next year. By changing your mindset and spending habits now, early in the year, you have time to become a Smart Spender who doesn’t have to worry about high-interest credit card debt by next holiday season.

Keep these tips in mind:

- Start a holiday savings fund now. Whether it’s simply a portion of your regular savings account funds that you allocate for holiday spending, or you create a separate holiday savings account, if you can save a little out of every paycheck now, you’ll feel a lot less pressure at the end of the year.

- Shop throughout the year. If you find something perfect for someone on your list, buy it early. You can keep the gifts in a closet and that’s one less person to buy for when November rolls around.

- Get your decorations off-season. Shopping for holiday decorations now means you’re buying clearance, so the prices are better now than at any other time of the year. Buying decorations for each holiday after the fact may not help you decorate this year, but you’ll be styling next year without breaking the bank.

Use this infographic

<a href="https://www.consolidatedcreditsolutions.org/es/infographics/new-years-resolution/" target="_blank"><img src="https://www.consolidatedcreditsolutions.org/wp-content/uploads/2017/04/your-new-new-years-resolution.png" alt="Graphic displaying which type of holiday shopper you are and how to deal with a holiday spending hangover" class="img-responsive" /></a>